Table of Contents

ToggleAAOIFI Public Hearings on Islamic Finance Exposure Drafts – Join the Discussion!

Greetings from the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI)!

AAOIFI is pleased to invite you to its upcoming public hearings on key exposure drafts (EDs) in Islamic finance. These sessions provide an opportunity for stakeholders to share their views, ask questions, and offer recommendations that will be considered by the relevant working groups and boards.

Event Details

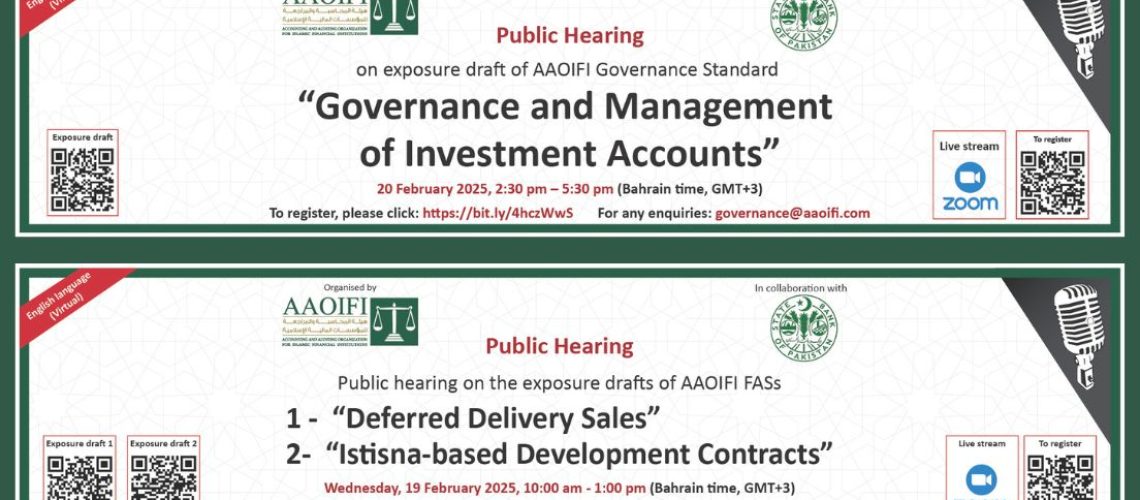

Public Hearing 1

Exposure Drafts:

- FAS on “Deferred Delivery Sales”

- FAS on “Istisna-based Development Contracts”

Date: Wednesday, 19 February 2025

Time: 10:00 AM to 1:00 PM (Bahrain, GMT+3)

Language: English

In Collaboration With: The State Bank of Pakistan

Registration Link: Click Here

ED Links: Deferred Delivery Sales - Istisna-based Development Contracts

Public Hearing 2

Exposure Draft:

- GS on “Governance and Management of Investment Accounts”

Date: Thursday, 20 February 2025

Time: 2:30 PM to 5:30 PM (Bahrain, GMT+3)

Language: English

In Collaboration With: The State Bank of Pakistan

Registration Link: Click Here

ED Link: Governance and Management of Investment Accounts

Why Attend?

These public hearings are crucial for ensuring transparency, stakeholder engagement, and the continuous development of Islamic financial standards. Participants will have the chance to:

- Share insights and suggestions on the proposed standards

- Engage with industry experts and AAOIFI representatives

- Contribute to the evolution of Islamic finance practices globally

Benefits of Taking Part in This Public Hearing

By participating in this public hearing, you will:

For “Deferred Delivery Sales” and “Istisna-based Development Contracts”

- Gain clarity on the principles governing deferred delivery transactions and their implications for Islamic finance.

- Contribute to refining guidelines that ensure fairness and risk-sharing in istisna-based contracts.

- Influence how these contracts are structured to better serve the needs of Islamic financial institutions and businesses.

- Help address potential Shariah compliance challenges in complex financial agreements.

For “Governance and Management of Investment Accounts”

- Provide input on the proposed governance framework for managing investment accounts in Islamic financial institutions.

- Help shape guidelines that protect investor rights while maintaining Shariah compliance.

- Understand how governance structures can enhance transparency, accountability, and ethical financial practices.

- Contribute to defining industry best practices for Islamic investment accounts.

Don’t miss this opportunity to be part of the conversation shaping the future of Islamic finance!

For more information, visit AAOIFI’s official website.